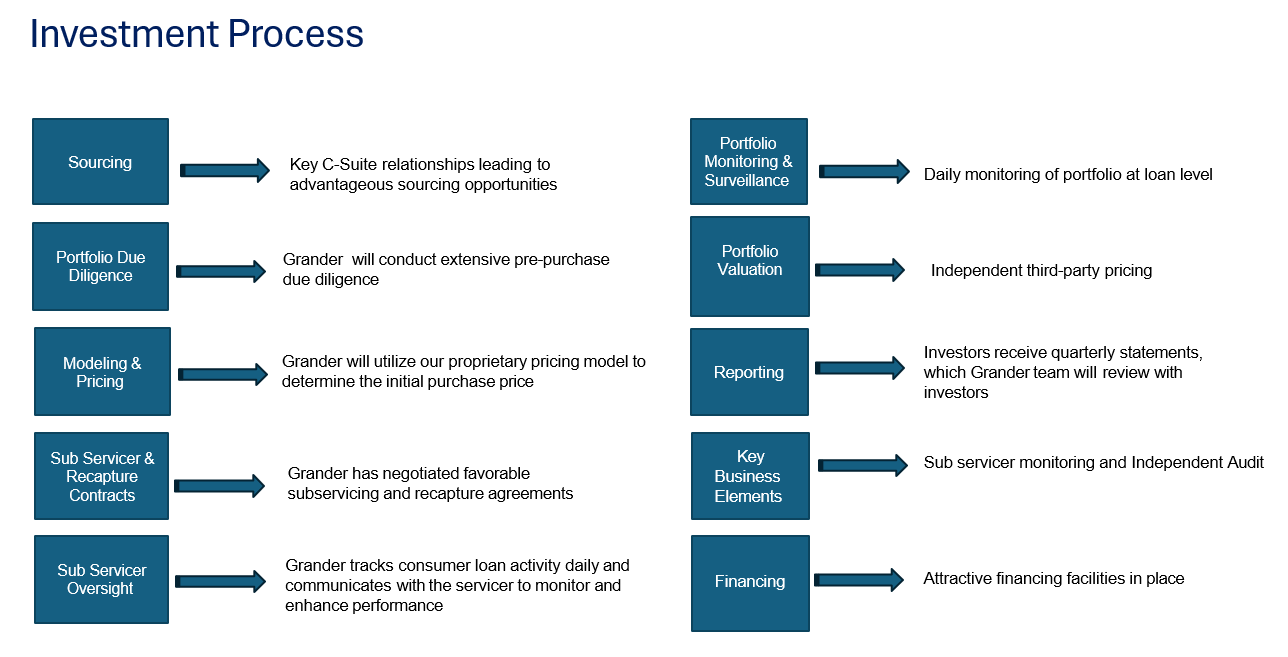

Investment Process

Our investment process has been developed and proven over different market environments. The Grander Investment Team employs a rigorous disciplined investment thesis relying on our 100 years of combined banking and investment management experience.

Sourcing

- Leverages deep C-suite relationships across banks and top originators for exclusive, off-market MSR flow

- Direct negotiations with sellers create advantages pricing not broadly available in the market.

- Benefits from long-term partnerships with sub-servicers and financing providers, creates a pipeline of attractive investment opportunities.

Portfolio Due Diligence

- Conduct comprehensive pre-purchase due diligence at the individual loan level.

- Reviews portfolio performance at loan level documentation integrity, GSE eligibility, prepayment trends, and servicer data accuracy.

Modeling & Pricing

- Utilize proprietary MSR pricing and evaluation model.

- Includes interest-rate sensitivity, prepayment forecasting, servicing cost inputs, and stress testing.

- Benchmarked against independent third-party pricing for accuracy and transparency.

- Ensures acquisitions meet target return thresholds.

Compliance

- Perform detailed compliance analysis to confirm adherence to FNMA/FHLMC and state regulations.

- Validation of borrower data, escrow procedures, and servicing transfer protocols.

- Continuous monitoring reduces operational and reputational risk and maintains regulatory standing.

Sub-Servicer Oversight

- Grander maintains daily online monitoring and direct communication with sub-servicers at the loan level.

- Oversight covers delinquency trends, loss mitigation timeliness, remittance accuracy, and quality of borrower communications.

- Utilize structured scorecards and escalation protocols to promote accountability and maintain consistent servicing quality.

Sub-Servicer & Recapture Contracts

- Maintains long-term, performance-based agreements with leading sub-servicing and recapture partners.

- Aligns economic incentives to prioritize borrower retention, recapture, and customer satisfaction to optimize yield.

- Contracts allow flexibility to reallocate or transition servicing if performance benchmarks are not met.

Portfolio Monitoring & Surveillance

- Analytics platform provides real-time, loan-level transparency into performance and valuation.

- Daily monitoring flags anomalies tied to payments, delinquency, or escrow activity.

- Enables rapid intervention and early risk detection, protecting asset value.

Portfolio Pricing

- Uses independent valuation to corroborate internal pricing and ensure transparency.

- Integrates daily market adjustments, including MSR trade levels, servicing expenses, and prepayment assumptions.

- Ensures valuations reflect true, realizable economic value.