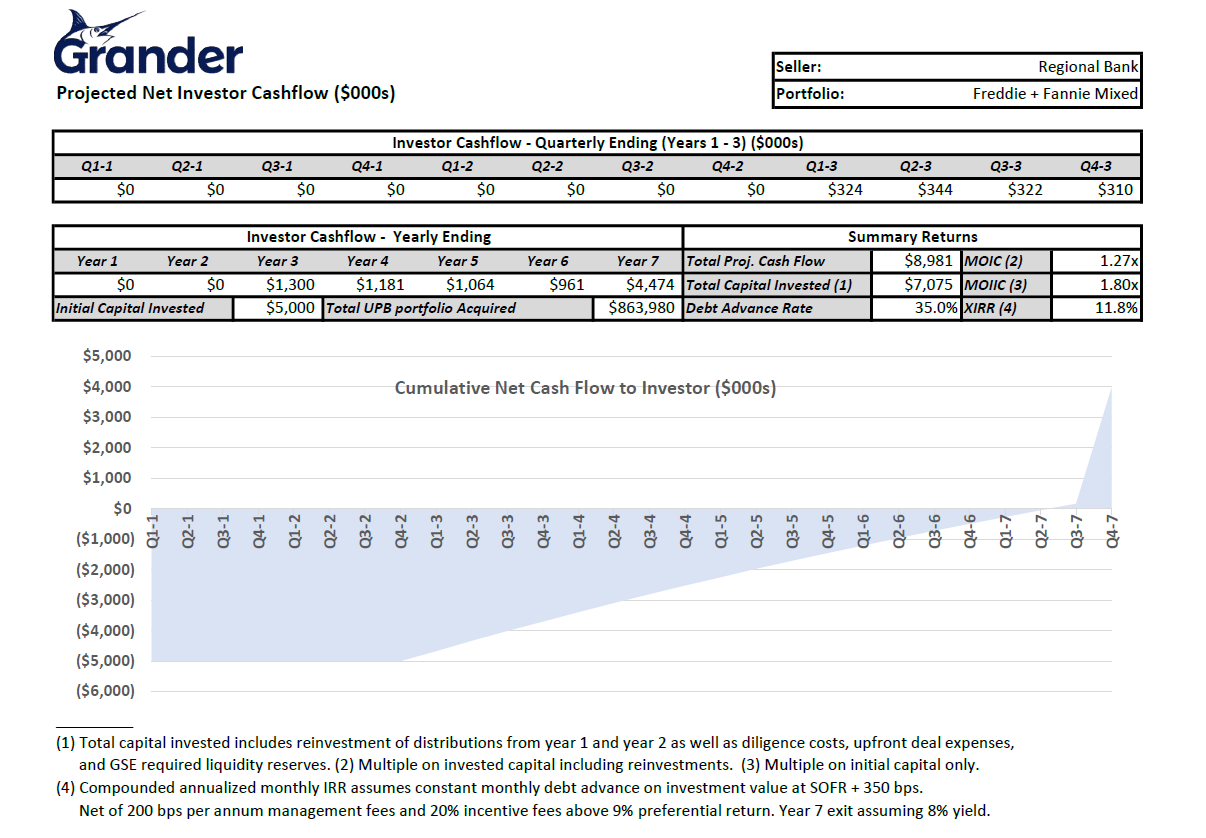

Projected MSR Cashflow**

** Past Performance – In considering any performance information contained within these documents, you should bear in mind that past or projected performance is not necessarily indicative of future results, and there can be no assurance that any entity referenced within these documents will achieve comparable results or that target returns, if any, will be met.